Why This Is a Strategic Advantage for Global Investors

In an investment climate where stability is as valuable as returns, Mauritius has emerged as Africa’s most secure and predictable destination in 2025. Ranked number one in the latest Africa stability assessments, the island nation continues to outperform its regional peers across governance, economic resilience, and geopolitical risk.

For international investors, this ranking is not just symbolic. It reinforces Mauritius’ position as a safe gateway for capital, particularly in real estate, financial services, and long-term portfolio diversification.

At STE Luxury Estates, we analyze markets where stability supports sustainable growth. Mauritius stands out as a market where investor confidence is backed by measurable fundamentals—not speculation.

What Does “Most Stable Country” Really Mean?

Stability rankings are not based on perception alone. They evaluate how well a country can withstand political change, economic pressure, and external shocks without disrupting business or investment environments.

Mauritius achieved the lowest overall risk score in sub-Saharan Africa due to:

-

Consistent democratic governance

-

Strong legal and regulatory institutions

-

Low exposure to regional conflicts

-

A diversified, services-driven economy

-

Long-standing openness to foreign investment

This combination creates an environment where capital preservation and growth can coexist—a rare balance in emerging markets.

Why Mauritius’ #1 Ranking Matters to Investors

1. Predictable Governance and Rule of Law

Mauritius has one of Africa’s most transparent political systems. Power transitions are orderly, institutions are independent, and property rights are clearly protected. For investors, this translates into low regulatory risk and high confidence in contract enforcement.

2. Economic Resilience and Diversification

Unlike commodity-dependent economies, Mauritius relies on a diversified mix of:

-

Financial services

-

Tourism and hospitality

-

Real estate development

-

International trade and technology

This diversity shields the economy from sector-specific shocks and ensures steadier long-term growth.

3. Investor-Friendly Legal Framework

Mauritius is widely recognized for its pro-business policies, including:

-

Clear foreign ownership laws

-

No capital gains tax on property

-

Attractive residency-by-investment options

-

Strong double taxation treaties

These features make it particularly appealing for international real estate and lifestyle investors.

4. Strategic Geographic Position

Positioned between Africa, Asia, and the Middle East, Mauritius acts as a financial and investment bridge. Many global investors use it as a base for African exposure while enjoying the stability of an island economy with global connectivity.

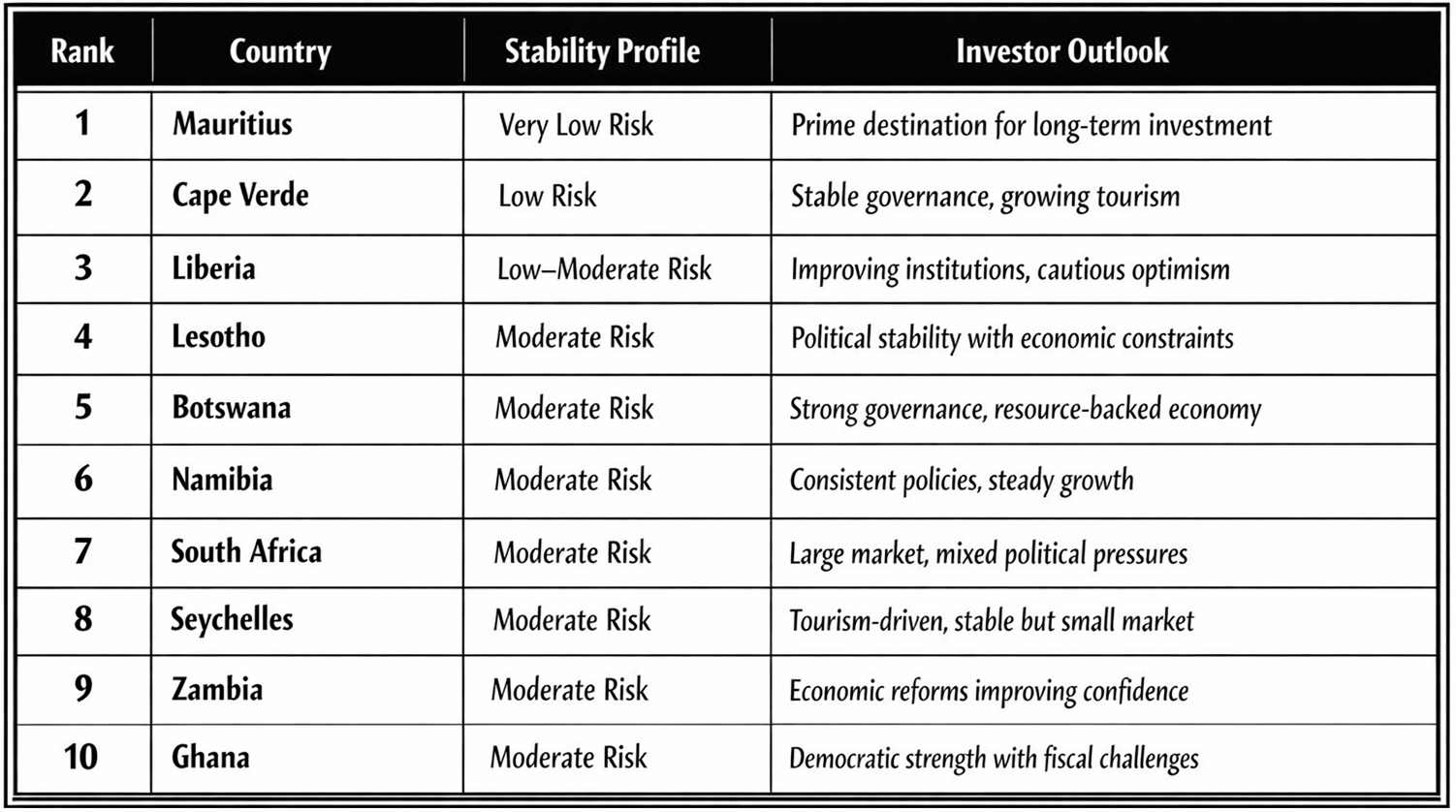

Stability Snapshot: Top 10 Most Stable African Countries (2025)

Below is a simplified and investor-oriented overview of Africa’s most stable countries in 2025, based on combined political, economic, and security indicators.

Lower risk scores reflect stronger stability and reduced exposure to political or economic disruption.

Mauritius and Real Estate: A Natural Investment Match

Mauritius’ stability directly strengthens its property market, particularly in:

-

Luxury beachfront residences

-

Branded resorts and villas

-

Gated residential communities

-

Investment apartments eligible for residency

Foreign buyers can legally purchase property under approved schemes, with clear title ownership and repatriation of funds—an advantage not widely available across Africa.

Rising demand from:

-

European investors

-

Middle Eastern buyers

-

African entrepreneurs

has supported consistent price growth and rental demand, especially in prime coastal and lifestyle-focused developments.

Stability vs. Volatility: Why Investors Are Shifting Focus

Across parts of Africa, investors continue to face:

-

Currency volatility

-

Political uncertainty

-

Security concerns

Mauritius offers a contrasting narrative: low volatility, high transparency, and long-term planning. This makes it particularly attractive for investors prioritizing wealth preservation alongside returns.

As global capital becomes more selective in 2025 and beyond, markets with strong fundamentals—not just high yields—are gaining attention.

Final Thoughts: A Safe Haven with Growth Potential

Mauritius’ ranking as Africa’s most stable country is more than a headline—it is a confirmation of what seasoned investors already recognize.

For those seeking:

-

Political certainty

-

Economic balance

-

Property-backed residency options

-

A secure African investment base

Mauritius stands in a league of its own.

At STE Luxury Estates, we guide clients toward markets where stability supports long-term value. Mauritius continues to meet that standard—and remains one of Africa’s most compelling investment destinations for 2025 and beyond.

For more details, call us: +230 5704 8022

For Visit Mauritus Properties : https://steluxuryestates.com/country/mauritius/

Join The Discussion